In Celestial Aviation Services Limited v UniCredit Bank AG [2023] EWHC 663 (Comm), handed down last week, Christopher Hancock KC sitting as a Deputy High Court Judge addressed the application of Russian sanctions to payment obligations arising between non-Russian parties. The Claimants, Irish-incorporated aircraft lessors, sought payment under letters of credit confirmed by the Defendant, UniCredit, in relation to leases of aircraft to two Russian companies entered into between 2005 and 2014. Although it was common ground that the Claimants had made conforming demands for payment, UniCredit claimed it was prevented from honouring the letters by Russian Sanctions imposed by the UK, the EU, and the US.

Rejecting UniCredit’s defence, the Court held that the Russian sanctions reflected in Regulation 28 of the Russia (Sanctions) (EU Exit) Regulations 2019 were intended to operate prospectively and therefore did not prevent payment under letters of credit given in connection with leases entered into before the Russian invasion of Ukraine. In doing so, the Court set out a useful discussion of the purposive approach to be taken in construing UK sanctions. It also emphasised the autonomous nature of the relevant payment obligation to reject UniCredit’s case that payment would be “in pursuance of or in connection with” an arrangement prohibited by the Regulations (i.e. the supply of aircraft).

In respect of US sanctions, UniCredit argued that they applied to prevent payment by virtue of the necessary involvement of a US correspondent bank in any US dollar denominated transaction. The Court disagreed: following Libyan Arab Foreign Bank v Bankers Trust [1989] 1 QB 728 it held that where a contract requires payment in dollars, the beneficiary is entitled to demand payment in cash. Accordingly, even if a transfer via a US correspondent bank was unlawful, UniCredit was not discharged from its obligation to make payment by other means. UniCredit had also failed to establish that as a matter of substance US sanctions prevented the relevant transaction. The judgment demonstrates the limits of the applicability of US sanctions to English-law governed payment obligations.

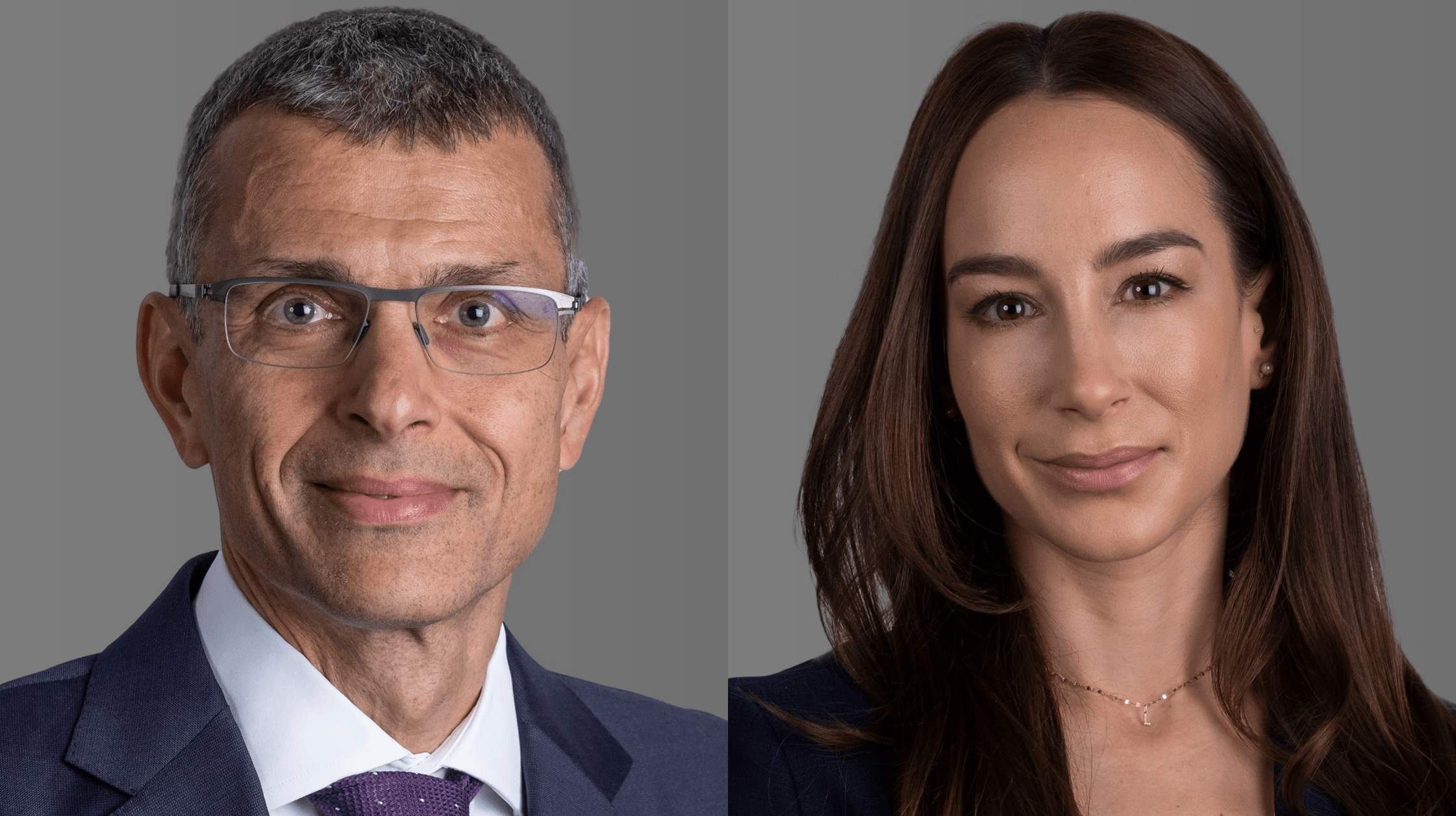

Akhil Shah KC and Leonora Sagan, instructed by Quinn Emanuel Urquhart & Sullivan, acted for the successful Claimants.

The judgment can be found here.