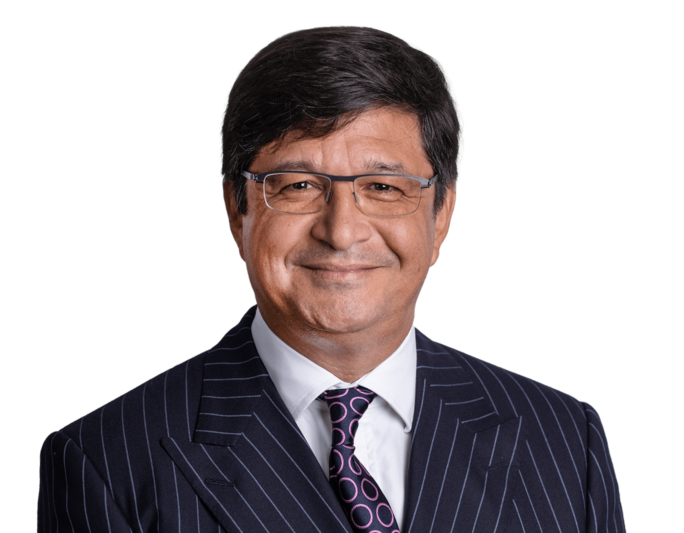

Nik’s regulatory practice has grown from his extensive financial practice, and from his previous life as a transactional solicitor advising financial institutions at a magic circle firm in London. He regularly advises on and litigates the Financial Services and Markets Act (FSMA), the Regulated Activities Order, the Financial Promotions Order, the FCA Handbook’s Business Standards (including COBS, MCOB, CASS, MAR), the Payment Services Regulations, the Electronic Money Regulations, AMLD5 (Money Laundering and Terrorist Financing Regulations), and the Market Abuse Regulation. He has extensive experience of advising on the “perimeter” of that regulatory regime, especially for fintech, including cryptocurrency platforms / services.

Notable Financial Services Cases

B2C2 v Quoine [2020] SGCA(I) 02 (Singapore International Court of Appeal)

Acting for the claimant in the ground-breaking cryptocurrency / algorithmic trading case, which dealt with questions of knowledge in automatic algorithmic trading of cryptocurrency.

Acting for the defendant FX currency dealer in alleged breach of Payment Services Regulations and Money Laundering and Terrorist Financing Regulations arising out of identity theft by the claimant’s representative.

Advising novel blockchain / distributed ledge technology (DLT)-based lending platform in establishing effective legal structure.

Advising a legal services firm on liability of banks as a result of push payment frauds and misdirected payment frauds.

Advising a cryptocurrency wallet provider in relation to e-money and regulated activities under Financial Services and Markets Act (FSMA), the Electronic Money Regulations, the Regulated Activities Order and Financial Promotions Order.

Advising DLT platform in respect of regulatory aspects of platform, particularly the issuance and dealings in utility tokens (coins) issued on that platform.

Acting for professional investor in a Singapore arbitration against a cryptocurrency exchange platform in relation to the “airdrop” of decentralised NFT tokens.

Advising international association of major copyright holders in its pursuit of copyright infringers who utilise cryptocurrency as a means of payment of infringing works.

Advising cryptocurrency exchange in relation to the Money Laundering and Terrorist Financing Regulations and freezing injunctions.

Advising the provider of an electronic fund-selection platform aimed at IFAs as to whether various proposed functionalities fell within the regulatory reach of the FCA, including application of the Electronic Money Regulations.

Advising well-known global charity in relation to various fund-raising issues.

Advising innovative social enterprise in the educational sector in relation to fund-raising.

Chopra v Bank of Singapore [2015] EWHC 1549 (Ch)

Which turned in large part on whether a foreign-based private bank’s relationship manager had to be authorised.

Advising an extremely large sports betting organisation on the scope of the FCA’s regulatory reach and whether particular activities it conducts would require the organisation to be authorised.

FSA v Cavendish Moore

Representing the provider of a UK land banking scheme in proceedings brought by the FSA.

Advising on the effect of FCA regulation on the conduct of financial business by certain limited partnerships.

Cattan v Mortlock

Dispute arising out of margin call demands by ANZ under PRIN instruments, entitling holders to a synthetic interest in ex-Russian Federation sovereign debt, including questions of regulatory compliance and professional negligence.

Advising on whether a single-member scheme set up for a solicitor’s firm was a collective investment scheme and attracts regulation as “financial promotion”.

Advising on LSE-listed pharma company in relation to dispute with AIM-listed company giving rise to alleged Market Abuse Regulation breaches.

Acting (pro bono) for client of broker in relation to alleged breaches of MCOB.

Acting for various high net worth bank employees in respect of alleged breaches of various financial regulations.

FRC v Rakow

Representing actuary in relation to alleged failures in the audit of a pension fund.

Advising distributed ledge technology (DLT) platform in respect of emulation (or wrapping) of another token on a rival DLT to function on the client’s DLT.

Representing FTSE-listed gaming entity in respect of UK/Cyprus e-money dispute under Electronic Money Regulations and Payment Services Regulations, against agent of FCA-authorised entity, where the FCA has already noted potential cloning issues in relation to that authorised entity.

Acting for large national e-platform in the “sharing economy” in respect of potentially unregulated insurance products offered to it, disguised as guarantees.